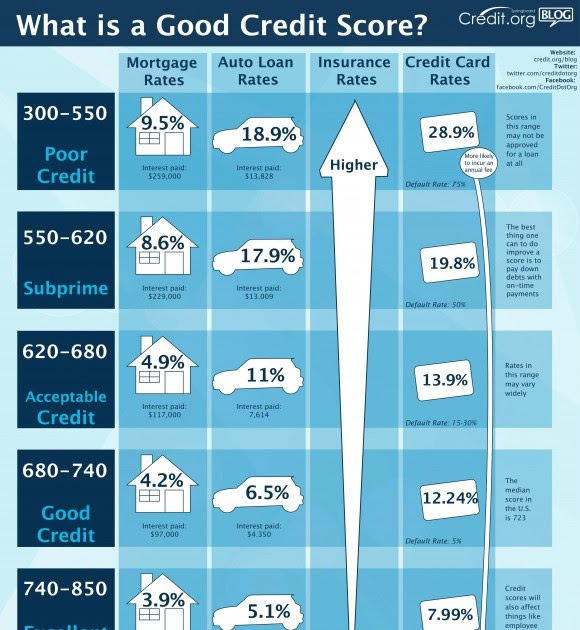

What can you do if your score is a little low? Check your credit report for any innacruate items, then you can partner with a reputable company like Credit Glory to dispute them. Looking for a credit report on Service Finance Company, LLC Our Business Information Report Snapshot is a collection of business credit scores and ratings. What Credit Score Does Ally Financial UseĪlly financial uses your FICO credit score when making decisions. What if your credit could use a little help? If there are inaccurate items on reports from any of these companies you can partner with Credit Glory to dispute & remove them. What Bureau Does Ally Financial Pull From?Īlly financial pulls from all three major credit bureaus - TransUnion, Equifax, and Experian. SBSS scores get pulled for SBA 7 (a) loan application prescreens as well. Are they reporting inaccurate information that's lowering your score? You can partner with a credit repair expert like Credit Glory to dispute the record. Were your score 800, you’d likely qualify for the most favorable terms long repayment periods, low interest rates, and more. You’ll need at least a 620 credit score to refinance your conventional loan (or into a conventional loan), though at that score, you’ll need a debt-to-income (DTI) ratio of 36 percent or. Were your credit score 650, you’d qualify, but you’d probably get a good-but-not-great deal. How Often Does Ally Financial Report To Credit Bureaus?Īlly Financial - like most lenders - reports to credit bureaus once per month. No Credit Needed means that you may be approved for financing or leasing without a credit score or credit history. For example, let’s say you’re applying to a loan that requires a minimum credit score of at least 650. How can you get your financial life back on track? Check your credit reports and, if you find any inaccurate items, partner with a reputable company like Credit Glory to dispute them.

Pre-approval with any company - including Ally Financial - is granted based on many factors like credit score & utilization ratio. How can you get pre-approved for an Ally car loan? However, lenders must request credit scores for each borrower from each of the three credit repositories when they order the three in-file merged credit report, described in B3-5.2-01, Requirements for Credit Reports. However, lenders tend to look at certain metrics when deciding if your business is performing well enough to receive a. You need a FICO score above 750 for your best approval odds with Ally Financial. Business loan requirements and applications are not standardized. At Credit Glory, we will scan your credit report for inaccurate items, and then dispute them to set you on the path to a healthy financial future. What is an Ally tier 1 credit score?Ī tier 1 score with many companies - including Ally Financial - is 750+.

Ensuring your revolving balances are low and that you have less than six inquiries will help. There are user reports of being approved with a score as low as 600. Ally Bank reports that you're "more likely to be approved" for their auto loans with a score of 640 or higher.

0 kommentar(er)

0 kommentar(er)